Fintech

Read the latest news and coverage of fintech, which stands for “financial technology,” focusing on everything from disruptor banks and innovations at established financial institutions to expense management startups, P2P payment services, checkout tools and the technologies that enable them.

AI hardware has taken on a new shape with Friend’s $99 necklace — a pendant that gives you an AI friend to talk to and…

Fintech Execs from Synctera, Unit, and Treasury Prime discuss the future of BaaS at TechCrunch Disrupt 2024

The serious, long-term negative impact of the bankruptcy of banking-as-a-service (BaaS) fintech Synapse will be significant “on all of fintech, especially consumer-facing services,” one observer has said. In the wake…

Welcome to TechCrunch Fintech! This week, we’re looking at Stripe’s easy-peasy acquisition, the role fintech played in Clio’s latest raise, the latest with digital banking startup Mercury, and more. To…

FranShares has a new approach to passive income, letting people invest in franchises for as little as $500

Historically, passive income has been associated with investing in real estate such as rental properties. FranShares is a Chicago-based startup that wants to offer investors another form of passive income:…

Welcome back to another recap of Equity, TechCrunch’s flagship podcast about the business of startups. Today’s episode is packed with M&A talk, how one YouTuber…

Payments giant Stripe has acquired a four-year-old competitor, Lemon Squeezy, the latter company announced Friday. Terms of the deal were not disclosed. As a merchant of record, Lemon Squeezy calculates…

MNT-Halan, a fintech unicorn out of Egypt, is on a consolidation march. The microfinance and payments startup has raised $157.5 million in funding and is using the money in part…

This is a significant milestone for the London-based fintech company, particularly since it has been trying to secure this license since 2021.

CRED, an Indian fintech startup, has rolled out a new feature that will help its customers manage and gain deeper insights into their cash flow, as the startup seeks to…

Digital banking startup Mercury abruptly shuttered service for startups in Ukraine, Nigeria, other countries

Digital banking startup Mercury informed some founders that it is no longer serving customers in certain countries, including Ukraine.

Welcome to TechCrunch Fintech! This week, we’re looking at Human Interest’s path toward an IPO, fintech’s newest unicorn, a slew of new fundraises, and more. To get a roundup of…

After doing some consulting for Microsoft to develop protections against zero-day exploits, software engineer Joran Dirk Greef worked with Coil, a web monetization startup in San Francisco, to help build…

Fragment’s digital ledger API applies real-time, double entry accounting to find where things aren’t adding up.

Featured Article

Pesa unlocks new markets to keep remittances flowing to emerging economies

Founders of Pesa, a remittance fintech, know too well how costly, inaccessible and unreliable remittance services drive people to opt for risky informal channels — like WhatsApp groups — to transfer money. Their firsthand experience using informal channels and realizing how prevalent their use was among Africans living in the…

Indian fintech Paytm’s struggles won’t seem to end. The company on Friday reported that its revenue declined by 36% and its loss more than doubled in the first quarter as…

Coast, a startup that describes itself as “a financial services platform for the future of transportation,” has raised $40 million in Series B funding — just four months after announcing…

Slope’s founders both have a background in AI, so large language models power the company’s underwriting infrastructure.

Ethereum co-founder’s warning against ‘pro-crypto’ candidates: ‘Are they in it for the right reasons?’

Vitalik Buterin, the co-founder of Ethereum, issued a warning on Wednesday against choosing a candidate purely based on whether they claim to be “pro-crypto.” In a blog post, Buterin said…

Matera raises $100M from Warburg Pincus to help the US catch up to Brazil in instant payments

To say that Pix, the instant payment system created by the Central Bank of Brazil, has been a resounding success is an understatement. With Pix, money moves directly between core…

Sequoia bets big on Stripe, LatAm fintechs clean up and one African startup’s outsized Series A

Welcome to TechCrunch Fintech! This week, we’re looking at Sequoia Capital’s effort to give its LPs liquidity on the firm’s investments in Stripe, how LatAm fintechs are still catching investors’…

Astor’s ‘community’ approach to financial advice aims to help women feel more confident about investing

Astor is a free personal finance platform for women that merges community and investing in an approachable way, came to be.

Payments giant Stripe has delayed going public for so long that its major investor Sequoia Capital is getting creative to offer returns to its limited partners. The venture firm emailed…

Real-time payments are becoming commonplace for individuals and businesses, but not yet for cross-border transactions. That’s what Caliza is hoping to change, starting with Latin America. Founded in 2021 by…

Adaptive is a platform that provides tools designed to simplify payments and accounting for general construction contractors.

Here is a timeline of Synapse’s troubles and the ongoing impact it is having on banking consumers.

Uzbekistan’s mobile-only bank TBC Bank Uzbekistan has raised $38.2 million in a fresh funding by its existing shareholders.

Meet Adfin, a new U.K.-based fintech startup that wants to help companies get their invoices paid — whatever it takes. Founded by two fintech experts, the company is starting with…

Welcome to TechCrunch Fintech! Last week was a holiday in the United States, so news was a bit lighter than normal. But there was still fintech-related items to report, including…

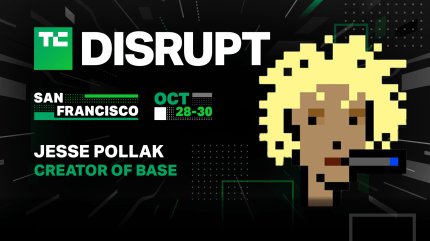

Jesse Pollak will tell us why Coinbase is launching its own Base blockchain at TechCrunch Disrupt 2024

We’re excited to invite Jesse Pollak to TechCrunch Disrupt 2024 to talk about the future of decentralization.

Nala, a remittance startup that is now widening its portfolio through a new B2B payments platform, has raised $40 million equity in a rare deal that becomes one of the largest…