Latest from Marina Temkin

The fundraising environment is challenging for emerging managers, defined as VC firms raising their first through third time. But Katie Jacobs Stanton, a former head of media at Twitter who…

Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups. To get Startups Weekly in your inbox every Friday, sign up here. This…

Until a year ago, Arjun Pillai had the comfortable yet important role of chief data officer at ZoomInfo, a B2B database company. But the serial entrepreneur was getting antsy. He…

Dental care is a necessity, yet many patients lack confidence in their dentists’ ability to provide accurate diagnoses and appropriate treatments. Some dentists overtreat patients, leading to unnecessary expenses, while…

Cybersecurity startup Wiz has turned down a $23 billion acquisition offer from Alphabet, Google’s parent company, according to a source familiar with discussions. Despite the offer representing a substantial premium…

This week, Google is in discussions to pay $23 billion for cloud security startup Wiz, SoftBank acquires Graphcore, and more.

PE firm PartnerOne paid $28M for HeadSpin, a fraction of its $1.1B valuation set by ICONIQ and Dell Technologies Capital

Canadian private equity firm PartnerOne paid $28.2 million for HeadSpin, a mobile app testing startup whose founder was sentenced for fraud earlier this year, according to documents viewed by TechCrunch.…

Menlo Ventures and Anthropic are teaming up on a $100 million fund dubbed “the Anthology Fund” to invest in pre-seed and Series A AI startups.

Marc Andreessen, the co-founder of one of the most prominent venture capital firms in Silicon Valley, says he’s been a Democrat most of his life. He says he has endorsed…

Former President Donald Trump picked Ohio Senator J.D. Vance as his running mate on Monday, as he runs to reclaim the office he lost to President Joe Biden in 2020.…

Alphabet, Google’s parent company, is in advanced talks to acquire Wiz for $23 billion, a person close to the company told TechCrunch. The deal discussions were previously reported by The…

Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the world of startups. Sign up here to get it in your inbox every Friday. This…

People in tech often say that data is the new oil. That phrase, coined by British mathematician Clive Humby, of course implies that data is valuable. Data about a person’s…

AI startup Hebbia raised $130M at a $700M valuation on $13 million of profitable revenue

Hebbia, a startup that uses generative AI to search large documents and respond to large questions, has raised a $130 million Series B at a roughly $700 million valuation led…

Seae Ventures is acquiring Unseen Capital after the death of founder Kayode Owens in 2021. The combined firm will continue to invest in healthcare for minorities and underserved populations. Owens,…

Featured Article

Valuations of startups have quietly rebounded to all-time highs. Some investors say the slump is over.

Generative AI businesses aside, the last couple of years have been relatively difficult for venture-backed companies. Very few startups were able to raise funding at prices that exceeded their previous valuations. Now, approximately two years after the venture slump began in early 2022, some investors, like IVP general partner Tom…

J2 Ventures, a firm led mostly by U.S. military veterans, announced on Thursday that it has raised a $150 million second fund. The Boston-based firm invests in startups whose products…

Granza Bio grabs $7M seed from Felicis and YC to advance delivery of cancer treatments

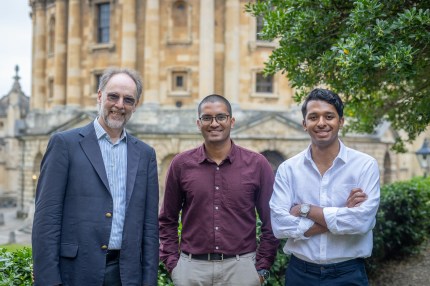

Ashwin Nandakumar and Ashwin Jainarayanan were working on their doctorates at adjacent departments in Oxford, but they didn’t know each other. Nandakumar, who was studying oncology, one day stumbled across…

Industry Ventures raises a $900M fund for investing in small, early-stage VCs and their breakout startups

The venture fundraising trend in 2024 is fairly clear by now: Large, established VC firms are continuing to attract capital from limited partners, while smaller, newer funds are finding it…

Kleiner Perkins announces $2 billion in fresh capital, showing that established firms can still raise large sums

Many VC firms are struggling to attract new capital from their own backers amid a tepid IPO environment. But established, brand-name firms are still able to raise large funds. On…

Hebbia raises nearly $100M Series B for AI-powered document search led by Andreessen Horowitz

Hebbia, a startup using generative AI to search large documents and return answers, has raised a nearly $100 million Series B led by Andreessen Horowitz, according to three people with…

Older adults increasingly want to age in their homes rather than nursing facilities. A study by the AARP (American Association of Retired Persons) found that nearly 90% of people over…

In the post-COVID world, VCs say it’s not as easy to get excited about investing in digital health. Deal activity in healthcare IT was relatively flat in Q1 2024 at…

Backed by David Sacks, Garry Tan and Walter Isaacson, Created by Humans helps people license their creative work to AI models

In 2024, it seems like no week goes by without a media organization, author group or artist suing generative AI companies for using their work to train models without permission.…

Khosla-backed Marble, built by former Headway founders, offers affordable group therapy for teens

Rates of depression, anxiety and suicidal thoughts are surging among U.S. teens. A recent report from the Center of Disease Control found that nearly one in three girls have seriously…

Christopher O’Donnell has hobbies. He likes music and playing guitar, but above all, he loves building software. Which is why three years after leaving HubSpot, he built Day.ai, a CRM…

Featured Article

How Abridge became one of the most talked about healthcare AI startups

Ask any of the health-focused VCs to name one of the top AI startups and one name comes up over and over again: a company based in Pittsburgh called Abridge. And it’s a startup that launched before OpenAI was a household name and large language models (LLMs) entered the common…

Tempus rises 9% on the first day of trading, demonstrating investor appetite for a health tech with a promise of AI

Tempus, a genomic testing and data analysis company started by Eric Lefkofsky, who previously founded Groupon, debuted on Nasdaq on Friday, rising about 15% on the opening. The company priced…

For centuries, people chewed willow tree bark to relieve pain, but scientists at chemical firm Bayer didn’t isolate its active ingredient until the 1800s and eventually patented its modified version…

Venture fundraising has been a slog over the last few years, even for firms with a strong track record. That’s Foresite Capital’s experience. Despite having 47 IPOs, 28 M&As and…