Latest from Christine Hall

Remark trains AI models on human product experts to create personas that can answer questions with the same style of their human counterparts.

If you’ve ever wanted to apply to Y Combinator, here’s some inside scoop on how the iconic accelerator goes about choosing companies.

For a $5.99 per month, immigrants have a bank account and debit card with fee-free international money transfers and discounted international calling.

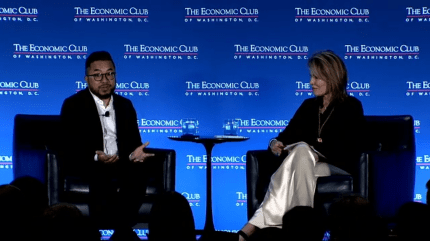

SoLo Funds CEO Travis Holoway: “Regulators seem driven by press releases when they should be motivated by true consumer protection and empowering equitable solutions.”

Kudos uses AI to figure out consumer spending habits so it can then provide more personalized financial advice, like maximizing rewards and utilizing credit effectively.

Bolt founder Ryan Breslow wants to settle an investor lawsuit by returning $37 million worth of shares

The investor lawsuit is related to Bolt securing a $30 million personal loan to Ryan Breslow, which was later defaulted on.

Cannabis industry and gaming payments startup Aeropay is now offering an alternative to Mastercard and Visa

The key to taking on legacy players in the financial technology industry may be to go where they have not gone before. That’s what Chicago-based Aeropay is doing. The provider…

Here are quick hits of the biggest news from the keynote as they are announced.

When Newchip, an online accelerator promising to help startups, filed for Chapter 11 bankruptcy in March 2023, it was revealed that the company had just…

So did investors laugh them out of the room when they explained how they wanted to replace Quickbooks? Kind of.

PeakBridge intends to invest in between 16 and 20 companies, investing around $10 million in each company. It has made eight investments so far.

Healthy growth helps B2B food e-commerce startup Pepper nab $30 million led by ICONIQ Growth

Co-founder and CEO Bowie Cheung, who previously worked at Uber Eats, said the company now has 200 customers.

We took the pulse of emerging fund managers about what it’s been like for them during these post-ZERP, venture-capital-winter years.

Cleaning the outside of buildings is a dirty job, and it’s also dangerous. Lucid Bots came on the scene in 2018 with its Sherpa line of drones to clean windows…

Mushrooms continue to be a big area for alternative proteins. Canada-based Maia Farms recently raised $1.7 million to develop a blend of mushroom and plant-based protein using biomass fermentation. There’s…

Here’s everything Apple just announced at its Let Loose event, including new iPad Pro with M4 chip, iPad Air, Apple Pencil and more

Today is Apple iPad Event day, and we bring you all the iPad goodness you can stand, including if some of the rumors are true of what’s coming, like a…

Featured Article

They thought they were joining an accelerator — instead they lost their startups

Lacey Hunter thought all was well as she put her startup through the three-month Newchip accelerator. Then the organization filed for bankruptcy in May 2023. Things went from bad to worse later that year when she discovered warrants of her company — rights to buy an ownership stake — had…

Chicago-based Hyde Park Venture Partners closes $98M Fund IV with two investments made so far

Hyde Park Venture Partners is known for having visibility into more than 90% of mid-continent startups and being early backers of companies like ShipBob, FourKites, G2, LogicGate and Dentologie.

“Teampay represents this new class of fintech companies that came up,” said Paystand CEO Jeremy Almond.

The company produces plant-based ingredients from raw microalgae biomass, generated from spirulina or chlorella, that it claims is more nutritious than meat.

Dripos brings together point-of-sale, mobile payments, employee management and payroll, loyalty and marketing automation and administrative functions like accounting and banking.

Featured Article

Fintech Fundid was shut down over interest rates and a strained cap table

To keep going, Fundid “needed to put up a lot more collateral because of the changing environment,” Stefanie Sample said.

SoftBank-backed TabaPay is buying the assets of a16z-backed Synapse, after it filed for bankruptcy

After a tumultuous year, banking-as-a-service (BaaS) startup Synapse has filed for Chapter 11 bankruptcy and its assets will be acquired by TabaPay, according to the two companies. The deal is…

Dataplor’s “secret sauce” combines technology and public domain data with a human factor, employing over 100,000 people, called Explorers, to validate all the data via computer.

Companies can identify qualified suppliers from Diagon’s network of equipment suppliers, system integrators and service providers. Then leverage a toolkit to manage those complex projects.

Overall, 16% of Maven’s portfolio companies have reached a minimum $500 million exit or valuation, which is 10x industry average, the firm said.

Don’t have time to be in Las Vegas? That’s OK: We’ve summed up the most important parts of this year’s Google Cloud Next.

Today, Yoshi Mobility settled into three business lines: preventative maintenance, virtual vehicle inspections and electric vehicle charging.

With Metalab Ventures, the venture arm will play the role of a long-term value investor, essentially “putting our money where our mouth is,” CEO Luke Des Cotes said.

Cross-border is hot right now, so it’s no surprise that one of the trends among Y Combinator’s Winter 2024 batch of nearly 30 fintech startups is how to more easily…